Bad Debts Written Off Journal Entry

Bad debts written off. CR Bad Debts Written Off Balance Sheet Account What the customer wants is not to move the balance in the customer account out to the special GL account.

Plus One Accountancy Notes Chapter 9 Accounts From Incomplete Records A Plus Topper Plus One Accou Accounting Basics Accounting Principles Accounting Classes

Bad debts written off during the current year.

. It should remain in the. Since the tax is payable regardless of collection status the debt is written off with the following journal entry. Already has 7000 in the provision for doubtful debt accounts from.

Prepare the necessary adjusting entries. The dealer records the accounts as bad debts after using collection support and yet is. August 21 2022.

Lets say youve been in business for a year and that of the total 300000 in credit sales you made in your first. From the bank column on the debit side of the Cash book. From the the Journal Proper Journal.

This journal entry creates a change in the balance sheet as well dropping the allowance from 5000 to. If the actual bad. Z that has a balance of USD 300.

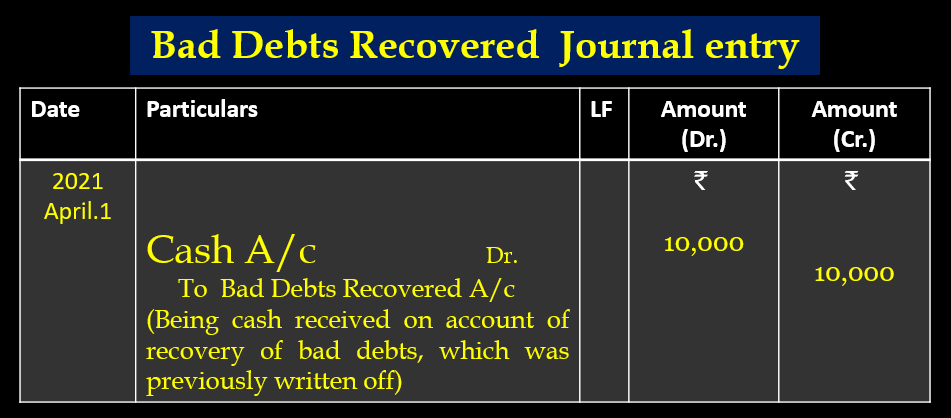

Percentage of bad debt Total bad debts Total credit sales. However on June 12 2021 Mr. When the amount that is earlier written as bad debts is now recovered it is called bad debts recovered.

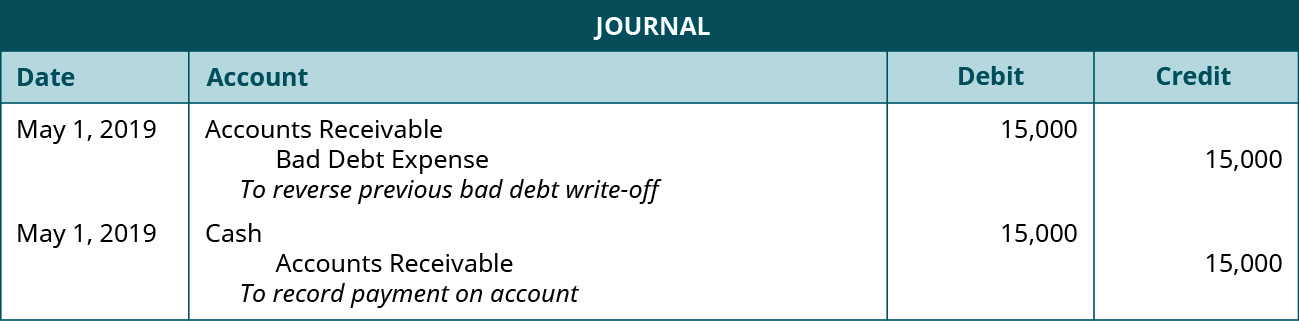

Heres how youd write off that receivable through a journal entry. The first approach tends to delay recognition of the bad debt. D paid the 800 amount that the company had previously written off.

A bad debt can be written off using either the direct write off method or the provision method. After the journal entry is made Sales still records. A car dealer finds out that three of the clients have not repaid their car loans.

The exact journal entries that need to be passed however depend on how the write-off of the receivable was recorded in the first place. Note the absence of tax codes. For example the company XYZ Ltd.

As per this percentage the estimated provision for bad debts is 12000 110000 10000 x 10. When an account receivable is. A sum of 2000 earlier written as bad debts is.

Decides to write off accounts receivable of Mr. 6800 Balance of Allowance for Doubtful Accounts at January 1 current year. The journal entries you will need to make depends on whether a general or specific provision needs to be created or whether a debt balance needs to be fully or partially written.

Refunds to trade receivables From. Once doubtful debt for a certain period is realized and becomes bad debt the actual amount of bad debt is written off the balance sheetoften referred to as write- offs. For example if your companys average DSO is 75 days you might.

To keep DSO daily sales outstanding from being skewed bad debt might be written off after a certain number of days. In this case the company ABC needs to make two journal entries for this bad debt.

Bad Debts Recovered Journal Entry Important 2022

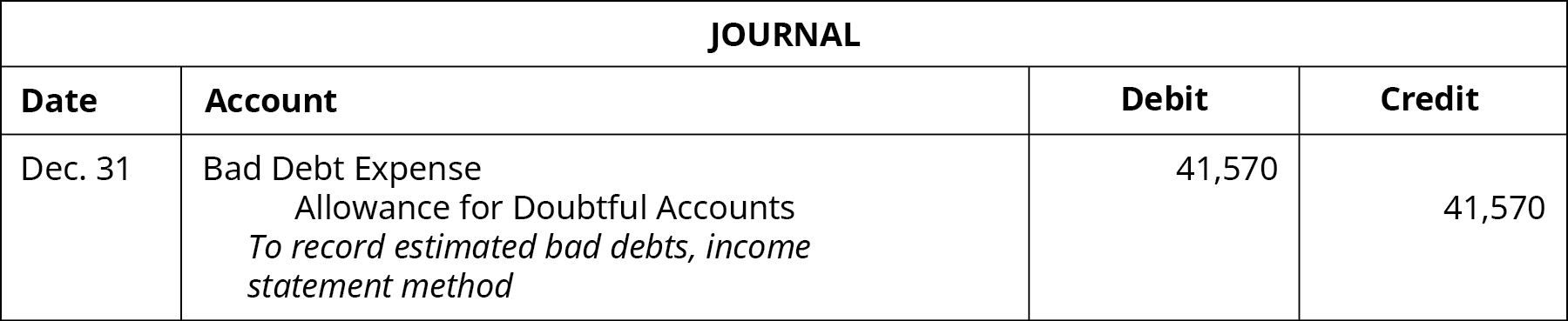

3 3 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting

3 3 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting

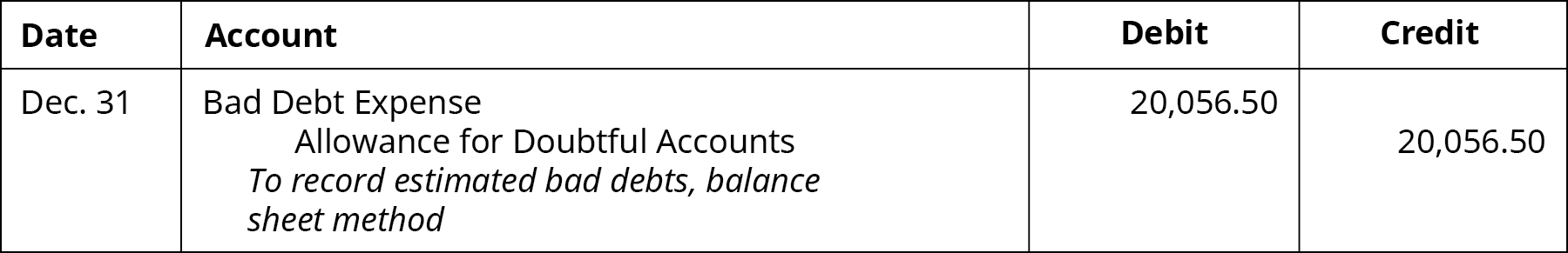

3 3 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting

3 3 Bad Debt Expense And The Allowance For Doubtful Accounts Financial And Managerial Accounting

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Comments

Post a Comment